How can you move from abysmal renter engagement rates to rates that blow industry averages out of the water?

Over the last few weeks, I've covered topics relating to nurturing and conversion, and I want to bring home why those ideas matter when it comes to (arguably) the most important metric of them all:

Performance.

I don't mean the number of emails you send or the pace with which you've been updating a property website.

When I say performance, I mean data.

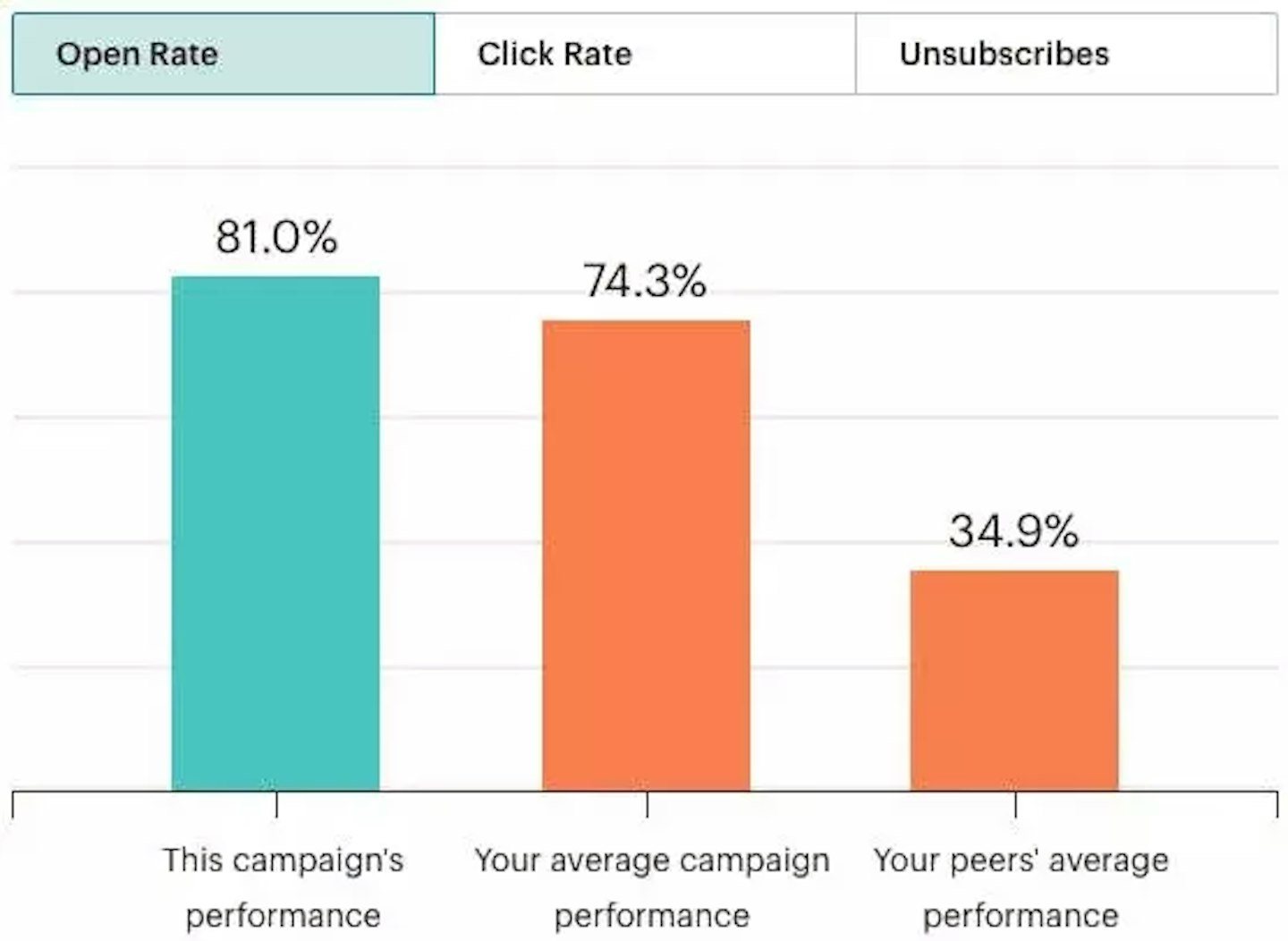

Today we're looking at 80% instead of 19%, to be exact.

If you've missed the last few editions, I've shared thoughts and steps to create nurturing campaigns for your properties. Overall, I believe these campaigns are grossly underutilized in the multifamily space.

A great campaign means thoughtfully curating your brand's assets, creating an experience onsite (even during construction), and extending that look, feel, and vibe to a website, all before a building is built.

The likelihood of a conversion is much higher when there is cohesion from physical to digital space.

And that brings me to last week's topic, which is conversions. Not website visits, not Instagram likes, but email signups. A metric that shows intent on behalf of a renter.

So how does this approach come full circle for a marketing and leasing team? In my experience, we see the flower beginning to bloom with email performance reports.

According to data from Mailchimp and similar platforms, the average email open rate for the real estate industry (including apartment rentals) is around 18-20%.

If you can believe it, that's slightly higher than the overall average. However, click-through rates tend to be lower in this industry, with an average of around 2-3%.

Remember that these averages are just a starting point and can vary depending on several factors, including the email list quality, the email's content and timing, list size, and the targeted audience. They also tend to shift YoY slightly depending on the reporting group.

For example, Mailchimp tells us that a list size <2,000 emails has an open rate average closer to 35%.

With all of that in mind, wouldn't it be great to see your campaign performance look like this every time?

To improve your email campaign's performance, consider testing different email content and strategies, segmenting your audience, and analyzing your metrics to identify areas for improvement.

But more than anything, give your audience a definitive reason to sign up in the first place!

Make sure that your onsite signage, splash website, and associated nurturing emails share the same look and feel, vibe, and core messaging.

If there is a buildup to fall leasing, make sure all avenues speak to that anticipation and excitement.

"Join the list" means nothing and definitely holds no specificity to a lease opportunity after a few months.

"Become a founding member" creates intrigue and curious interest, insinuating that a transaction will eventually occur.

The more hyper-focused we can be in directing the future renter, the better performance numbers we see, too.

Email performance has a low bar.

Taking the extra steps to make the renter journey even a bit more thoughtful and unique (especially as compared to the comps in the area) can move the needle significantly.

It's tricky talking about performance without talking about leases signed, no doubt.

When we work with our partners, it's impossible to say how the lease-up will run because we don't control many market factors.

What we can confidently say to our development, owner, and operator partners is that there is no reason not to nurture renters for months ahead of preleasing.

Not only have we seen a property stabilized months ahead of schedule, but we've also seen renters reaching out to sign a lease the moment that the "go" email hits in the inbox.

And that's a beautiful thing.

Lease up faster, boost NOI from the jump, and treat customers well from the beginning.

That's what it's all about.

Discover why boutique multifamily buildings outperform their larger competitors by focusing on curated experiences, intentional design, and emotionally resonant branding.

Discover how data-driven branding strategies can accelerate leasing, boost NOI, and turn your multifamily property's identity into a measurable performance asset.

Your brand’s reputation is built—or broken—at the leasing desk. Are you ready to unify leasing and marketing to protect it?

Remember when we all DIY dip-dyed our hair in Kool-aide and learned just because you can do it yourself doesn't mean you should? This week we're digging into the hidden costs of DIY'd branding.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.