It’s been an interesting few weeks in that I’ve found myself out of my “depth” a bit and in conversations that relate to leasing quite often.

Not to say that I don’t dabble in the leasing world, of course, but it’s not been the conversation starter in most instances.

For whatever reason, lately, that’s been changing. And I think I might know why.

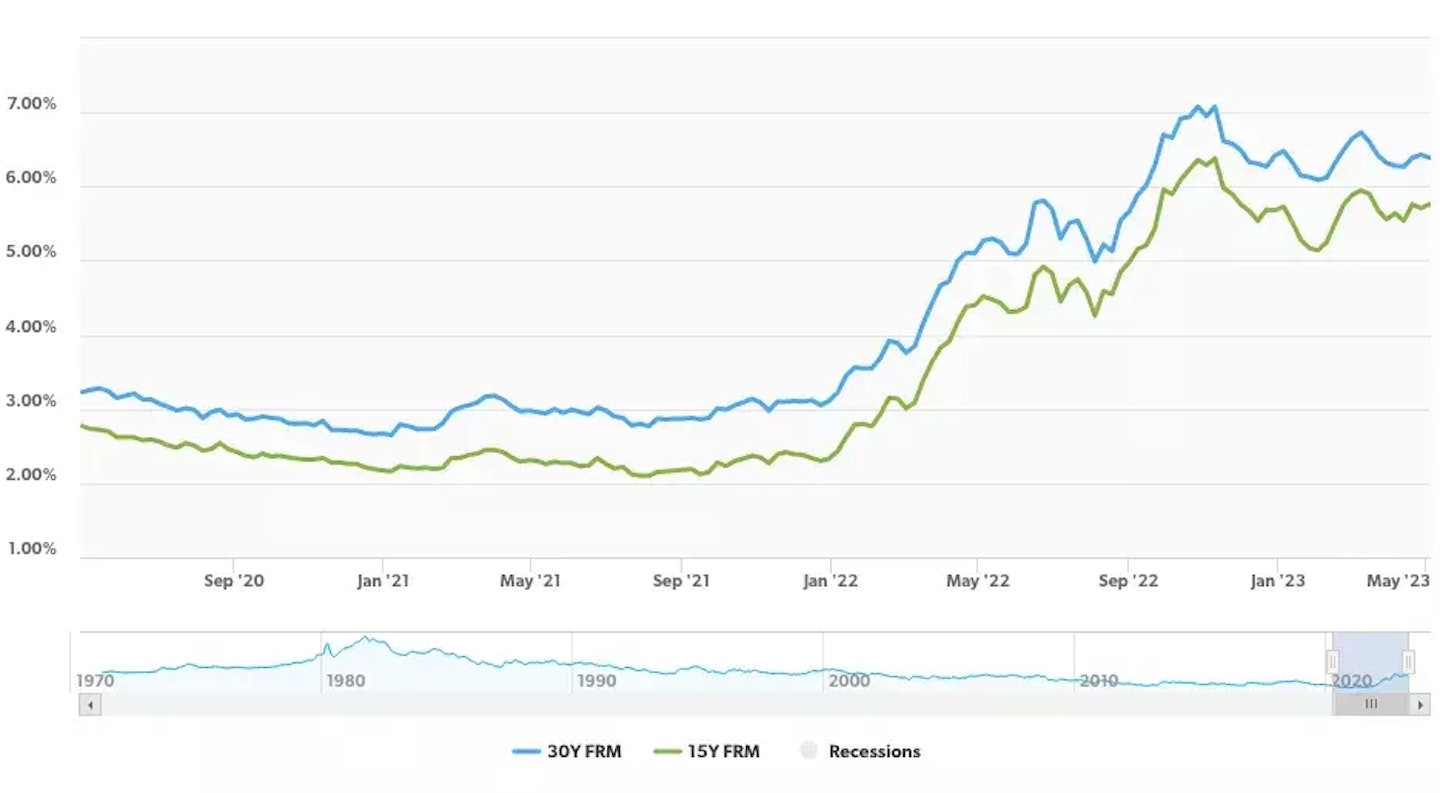

This week the Fed raised rates once more, maybe/hopefully/perhaps for the last time. One of the headlines I caught was that they “opened the door to pause the tightening cycle,” which made me chuckle a bit.

Throughout these increases over the past many months, capital is slowing down, deals are moving much slower, and sometimes seizing altogether.

A little cherry on top that Jay Parsons shared late last week is coming in the form of insurance coverage for property owners, too. (Up almost 50% in key coastal markets.)

It's rough out there for some groups: deals are going up in smoke, and worse, poorly positioned deals on the debt side are selling for losses.

Yet, out of this turmoil has come an awakening.

Actually, I won’t call it that quite yet, but I do see a few signals that the tides are turning. And they’re changing specifically around the importance of teeing up a strong leasing cycle.

What am I hearing?

Now, more than ever, these groups are not going to be able to go back to phoning it in - ever again.

Brand identity, positioning, and the onsite experience will matter (light years) more than it ever has in the past. That means the leasing experience, too.

Everything from a meaningful name to the evocative nature of the story to the website itself (no more crummy templates) will be huge in moving the needle. But the handoff and coordination with a leasing team must be a win, too.

Doesn't matter the size, either.

I’ve heard the same things from boutique guys and gals to the bigger groups.

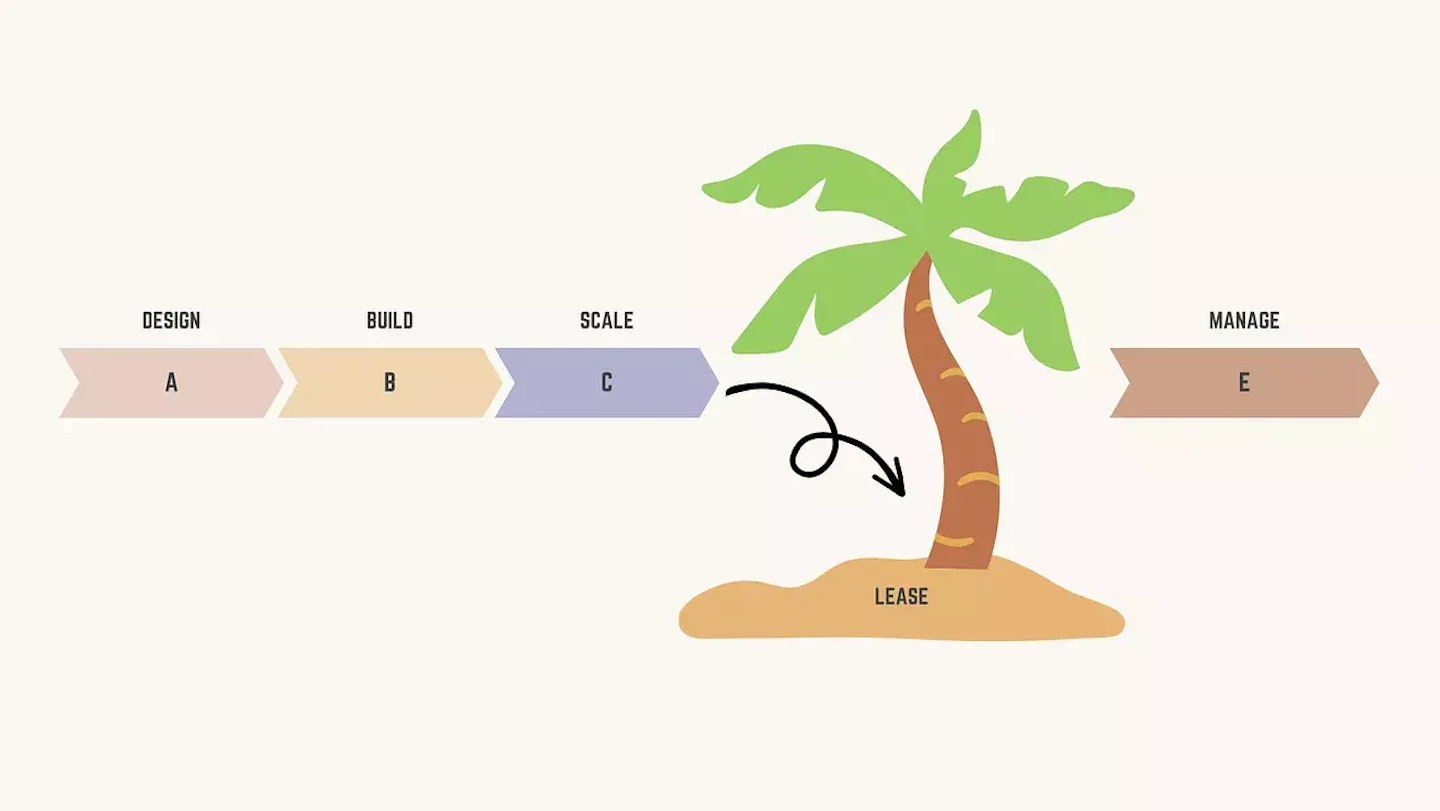

It brings to mind the common break I see in the larger go-to-market strategy that a lot of properties face.

More often than not, and despite our best efforts, the net result generally looks something like the illustration above.

However well-intentioned, leasing ends up on its own island.

A shaky handoff occurs between the marketing and leasing team – professional or not – that will usually result in a soup with various ingredients.

And in my head, this is the stereotypical Leasing 101 happening with many groups.

The new way of thinking about this cycle, I think, is gaining clarity in many real estate minds today.

Generally speaking, the perfect tee-up would look more like this:

I say that from experience.

Our very best outcomes, by far, align when we are able to have a very symbiotic relationship with the leasing team from the beginning.

And so today, just about to mid-2023, I’m finding this to be a laser focus amongst all of the uncertainty around the direction of interest rates and capital investment.

Supply will increase, demand will drop, and this “new” Leasing 101 cycle will matter more than it has in many, many, many years.

It’s just a matter of time.

Picking a name out of a hat, slapping together some graphics from a signage company, and going with the price-leading leasing company won’t be the thing in the future. Truthfully, it doesn’t work well today, either.

That’s what will make the biggest impact post-2022. As I said, I already see this mindset taking shape.

Not for everyone, but for the bright few that are tapping in.

Discover why boutique multifamily buildings outperform their larger competitors by focusing on curated experiences, intentional design, and emotionally resonant branding.

Discover how data-driven branding strategies can accelerate leasing, boost NOI, and turn your multifamily property's identity into a measurable performance asset.

Your brand’s reputation is built—or broken—at the leasing desk. Are you ready to unify leasing and marketing to protect it?

Remember when we all DIY dip-dyed our hair in Kool-aide and learned just because you can do it yourself doesn't mean you should? This week we're digging into the hidden costs of DIY'd branding.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.