When it comes to multifamily development, marketing often gets treated as optional—a flexible line item that’s easy to trim. But let’s look at it from a different perspective: what if your marketing budget is actually the insurance policy for faster ROI and higher perceived value?

A well-planned marketing strategy isn’t just another expense. It’s the engine that drives qualified leads, faster lease-ups, lower concessions, and stronger sales. When done right, marketing creates momentum that pays for itself many times over.

So, let’s tackle the million-dollar question - see what I did there?

“What should I spend on marketing a new development to see faster ROI?”

Here’s our proven formula:

Why these numbers? Let’s break it down.

Speed and conversion rates are two key performance indicators when you’re taking a lease up to market. The faster you get leads, to apply, to approved, to lease signed, the faster you hit stabilization, meet your NOI targets, and reduce carrying costs.

But in today's market, this momentum of qualified traffic eagerly converting doesn’t happen by accident—it requires a deliberate financial strategy and the right resources. Let's break it down.

To build momentum, your marketing plan needs to do more than check the boxes. While internet listing services (ILS) are valuable, they’re only part of the equation. There are multiple avenues you can take to ensure faster ROI through strategic marketing spend, but here is a great head-start:

These elements work together to create a property that not only stands out but captures the imagination of prospective renters. This is how you build early momentum and get ahead of your competition.

Here’s where things can go wrong: when marketing budgets are cut, properties often default to bare minimum strategies. This can create a cascade of challenges:

When done right, it’s an investment that keeps paying dividends, cycle after cycle and even after disposition.

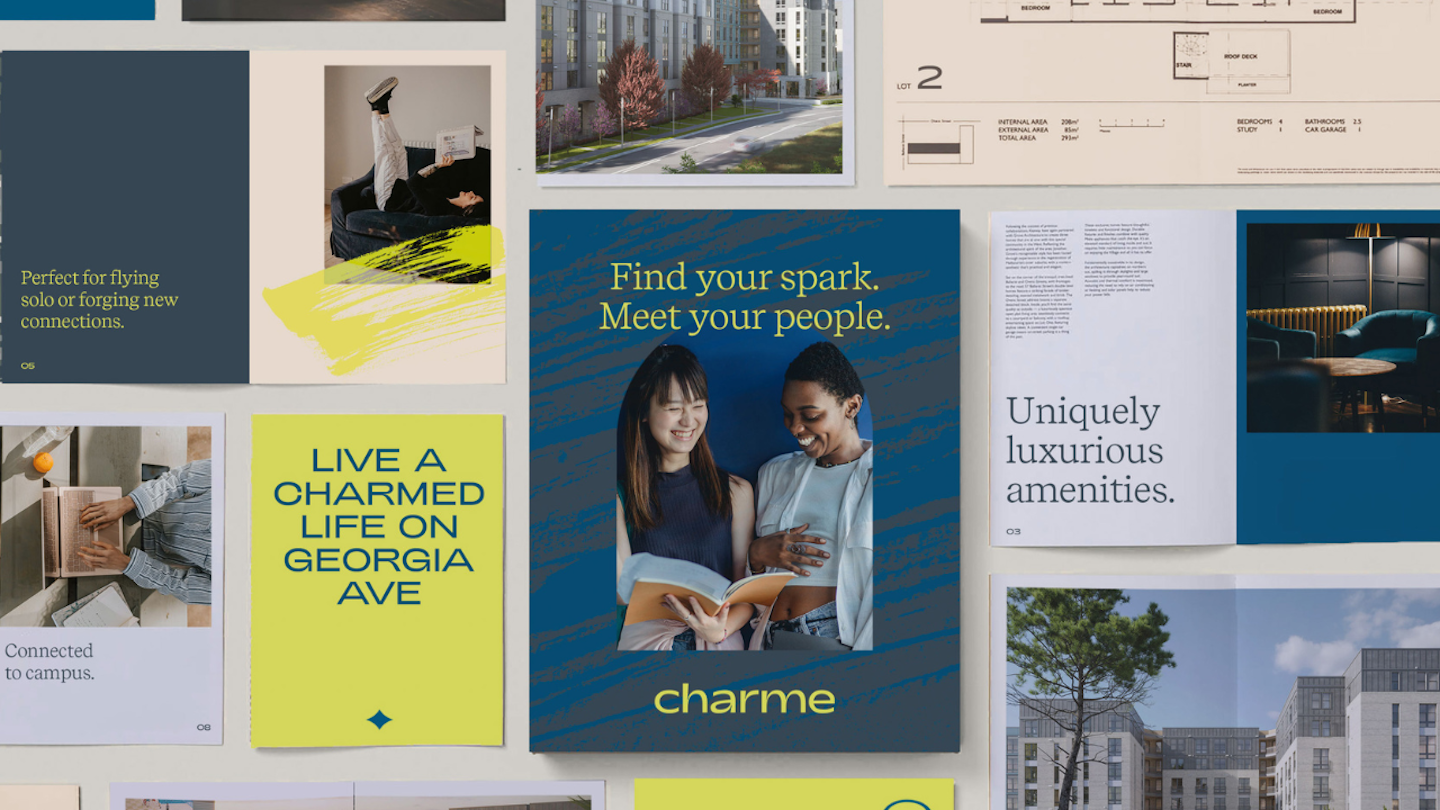

Selling condominiums is a different game entirely. Buyers aren’t just renting—they’re making a significant investment, both financially and emotionally. Your marketing must reflect that level of commitment and sophistication. Think about the feeling of leasing a sports car versus buying your dream car.

Totally different motivations and buying decision factors, right?

Condo buyers demand more than basic details; they want an experience that validates their decision. A 1% marketing budget allows you to deliver high-caliber everything at usually a smaller unit count than a 300-unit lease-up, for example.

When the buyer can sense you spent the money to create a seven-star sales experience, it translates to faster sales, fewer unsold units, and a higher dollar per square foot.

Regardless of whether you’re leasing apartments or selling condos, starting early is the golden rule. Campaigns launched 18-14 months ahead of completion allow you to:

This approach reduces carrying costs, shortens lease-up timelines, and positions your development as the market leader—not an afterthought.

By allocating 0.50% of the project value for lease-ups or 1% for condos, you’re spending upfront but seeing 2x, 3x, and even 4x ROI. We know this is a proven approach to discerning marketing spend for multi-million dollar assets, especially in a saturated market.

Discover why boutique multifamily buildings outperform their larger competitors by focusing on curated experiences, intentional design, and emotionally resonant branding.

Discover how data-driven branding strategies can accelerate leasing, boost NOI, and turn your multifamily property's identity into a measurable performance asset.

Your brand’s reputation is built—or broken—at the leasing desk. Are you ready to unify leasing and marketing to protect it?

Remember when we all DIY dip-dyed our hair in Kool-aide and learned just because you can do it yourself doesn't mean you should? This week we're digging into the hidden costs of DIY'd branding.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.