ILS, KPI, PPC- there is no shortage of confusing acronyms to muddy the waters of multifamily marketing efficacy, especially as AI-powered search becomes more sophisticated.

But every year, when budgeting approvals roll in, and reallocations start to unfold, multifamily marketers are faced with a critical question: invest in traditional apartment listing services (ILS) or pivot toward pay-per-click (PPC) advertising on platforms like Google and Meta?

Or slice and dice the two?

Both strategies offer advantages, but the best choice depends on factors like budget, goals, and target audience preferences. By understanding the strengths and costs of each approach, you can optimize your marketing spend and maximize leasing results for your new development.

PPC advertising has gained popularity in multifamily marketing due to its flexibility, cost efficiency, and precise targeting. Unlike ILS platforms, which often require fixed annual subscriptions, PPC allows marketers to adjust spending in real time and allocate budgets based on immediate needs.

PPC campaigns on Google and Meta are particularly effective for driving traffic directly to a community’s website. Using models like Cost-Per-Click (CPC), marketers pay only when prospects click on an ad, ensuring a direct correlation between spending and results. For multifamily communities experiencing increased vacancies or seasonal leasing challenges, PPC provides a fast, scalable way to generate leads.

Property Class and Unit Count: Larger and luxury (A-class) communities tend to require higher ad budgets due to their need for greater visibility and increased competition. For example, A-class properties spend between $360 and $3,000 per month on PPC, while C-class properties may spend as little as $150 to $1,230.

Targeting and Relevance: Google and Meta reward highly relevant campaigns with lower costs. By targeting precise keywords, such as “[community name] apartments” or location-based searches, communities can reduce their cost-per-click and drive more qualified traffic.

Campaign Design: Poorly designed ads with weak calls-to-action (e.g., “Rent Now”) or broken landing pages will waste budget and fail to convert prospects. Clear, actionable prompts like “Take a Virtual Tour” or “View Floorplans” work far better.

Compared to ILS, PPC also enables real-time insights into performance. This allows marketers to make data-driven decisions and scale up campaigns for higher-performing communities or scale down for those that are already stabilized.

ILS platforms like Apartments.com and Zillow have been a staple of multifamily marketing for years, serving as a central hub for renters searching for available apartments. These platforms provide high visibility, especially for renters who may not know specific properties to search for. However, ILS comes with significant drawbacks, particularly in terms of cost-effectiveness and limited flexibility.

Annual ILS contracts can cost tens of thousands of dollars, often with minimal ability to adjust based on performance. For example, in one case study, a property spent $54,000 annually on one ILS, yielding a cost-per-lease of $4,000, while PPC campaigns for the same property delivered a cost-per-lease of just $905.

That said, ILS can still drive meaningful results when enhanced with best practices, such as:

Tour Scheduling Options: Listings that allow renters to schedule tours directly through the platform see a 71% higher conversion rate. Renters value instant convenience and are less likely to engage with communities that require delayed responses through phone or email.

Virtual Tours: Including virtual tours increases conversion rates by 57%, as renters prefer immediate access to detailed property visuals. This feature can quickly convert casual browsers into serious prospects.

Online Leasing: Listings with online leasing tools achieve 5.5 times higher conversion rates. If renters can lease a unit on the spot, they are less likely to continue searching for alternatives.

Reviews: Properties with 10-20 reviews have triple the conversion rates of those without reviews, and listings with 30 or more reviews convert at eight times the rate. Positive reviews build trust and credibility, making your property stand out in competitive markets.

However, while these features can improve ILS performance, they still don’t address the platform’s higher cost-per-lease compared to PPC campaigns.

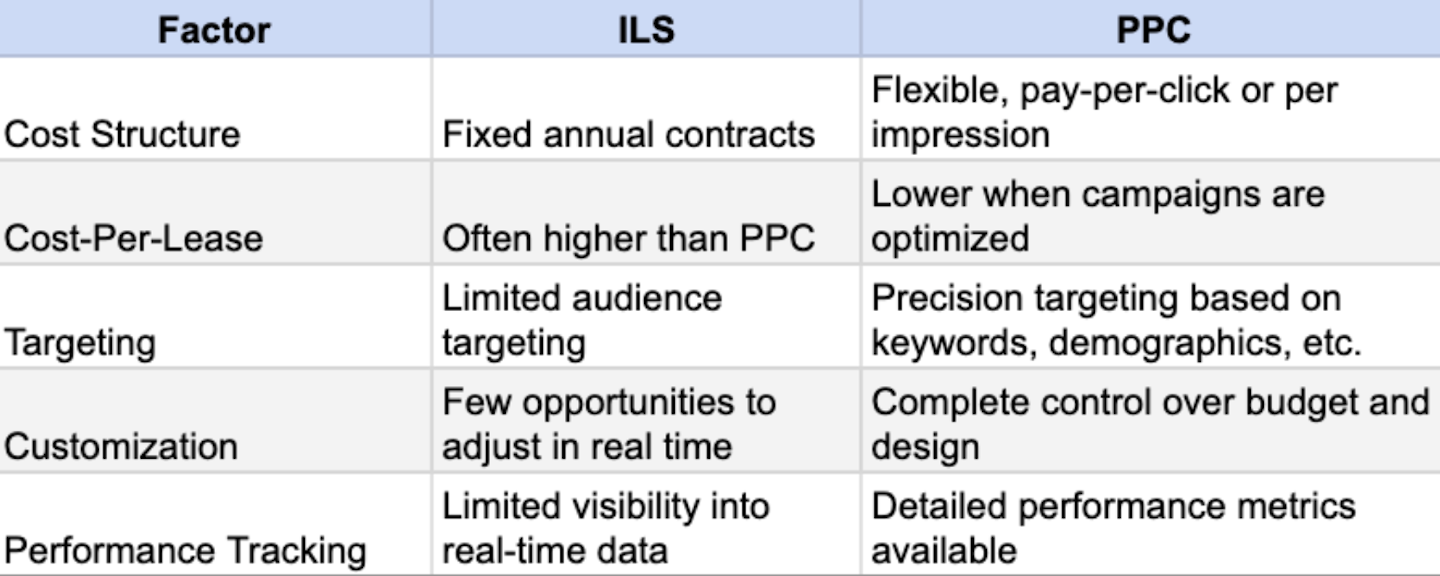

When comparing ILS and PPC, the decision often comes down to cost-efficiency, flexibility, and the ability to track ROI. Here’s how the two approaches stack up:

For many multifamily communities, a hybrid approach may work best. ILS can provide brand awareness and visibility for renters in the early stages of their search, while PPC offers targeted campaigns to drive website traffic and convert leads.

In today’s competitive multifamily market, understanding the strengths and weaknesses of ILS and PPC is essential to creating a winning advertising strategy. While ILS can still deliver results, its high cost-per-lease and lack of flexibility often make PPC a more attractive option for communities looking to maximize their budgets.

Ultimately, marketers must adopt a data-driven mindset. Regularly reviewing campaign performance, ad spend, and conversion rates will reveal where your efforts deliver the best ROI. By balancing traditional approaches like ILS with the precision and scalability of PPC, you can ensure your marketing strategy meets the demands of renters while staying ahead of the competition.

Discover why boutique multifamily buildings outperform their larger competitors by focusing on curated experiences, intentional design, and emotionally resonant branding.

Discover how data-driven branding strategies can accelerate leasing, boost NOI, and turn your multifamily property's identity into a measurable performance asset.

Your brand’s reputation is built—or broken—at the leasing desk. Are you ready to unify leasing and marketing to protect it?

Remember when we all DIY dip-dyed our hair in Kool-aide and learned just because you can do it yourself doesn't mean you should? This week we're digging into the hidden costs of DIY'd branding.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.

A simple read in under 5 minutes, delivered to your inbox Saturday mornings.